Free UK VAT calculator

Use this free online VAT calculator to work out prices including and excluding VAT. We also give a brief explanation of what VAT is, how to charge it, the different VAT rates and how Brexit might affect VAT in the UK.

Table of Contents

What is VAT?

VAT, or Value Added Tax, is a consumption tax applied to sold goods and services. It is also considered an indirect tax due to that businesses charge it from their customers and pays it forward to the government.

VAT Calculator

How to charge VAT

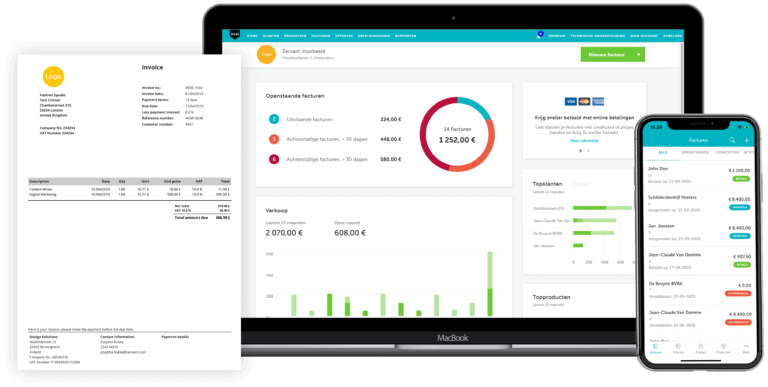

VAT is an indirect tax, which means that you have to charge your customers VAT on top of your prices when you sell them goods or services. If you invoice your customers you need display the total VAT amount separately on the invoice. Here is a good free invoice template that does this for you automatically. Or even better, use this invoicing software with free VAT reporting.

VAT rates in the UK

There are currently 3 different VAT rates in the UK. The standard rate of 20% applies for most goods and services. A reduced rate of 5% is sometimes applicable, depending on the item (e.g. children’s car seats, and mobility aids for elderly people) and the circumstances of the sale. The zero-rate VAT is used for e.g. most food items and goods supplied to a customer in another EU or Non-EU country. You can read more about the different VAT rates.

Will Brexit affect VAT in the UK?

The UK will continue to have VAT if the UK leaves the EU. And even in the case of a no deal, VAT would work as normal for domestic transactions. But there could be some changes related to transactions between the UK and other EU states. You can read more about how a no deal would affect such transactions.

If you liked this free VAT calculator you might also want to check out our free pricing tool, which lets you benchmark your prices against your competitors.