A Beginner’s Guide to Mileage, Expenses and Small Business

Are you a small business owner? Do you want to claim expenses for the business trips you make in your car (or van) or even with your bike? Once you collect your receipts, log your mileage, and put it all together things start to get quite complicated!

Zervant has put together this complete guide to mileage and travel expenses. It contains a list of the key questions (and answers!) we think you’ll need. And it’s specifically aimed at the UK.

If you find it useful be sure to check out our online invoicing software too.

Table of Contents

What Counts As A Travel Expense?

Let’s start by defining exactly what small businesses can claim as a travel expense:

- Any trip (the official term is “business travel”) you make in your own vehicle. The trip must be directly related to work.

- “Vehicle” here includes a car, van, motorcycle or bicycle.

- HOWEVER, this does not include your normal commute to and from work.

- But it does include travel to see customers, site visits, collecting supplies, and so on.

It’s also essential to keep an accurate, up-to-date record of all this travel. Which is actually a breeze if you use our rather marvelous, free mileage log.

How To Calculate Travel Expenses.

There are 2 methods for this.

1. The Mileage Rate Method.

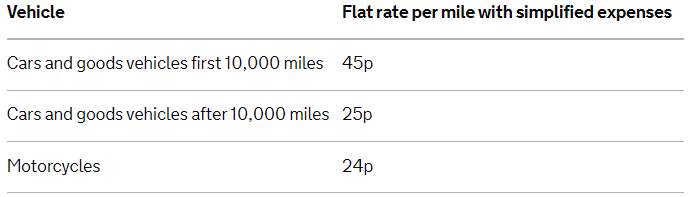

You’ll also hear this called simplified expenses. You work out your travel expenses by applying a flat rate to the number of “business travel” miles you do in a year. HMRC’s current flat rates are as follows:

2. The Full Rate Method.

The other option for calculating your expenses is to work out each and every cost separately, and then claim back expenses. These costs include everything related to buying and running your vehicle. Such as insurance, fuel, the cost of the vehicle, MOT and servicing.

But again, whatever option you choose, it’s essential you keep an accurate, updated mileage log of your travel.

What’s The Best Option For Small Businesses?

If you’re a sole trader and you’re not VAT registered, you can use either of the above options. If you’re VAT registered, then you must use the full rate method. Limited companies are slightly more complicated (more on that below).

“It really depends on what type of business you have, and on how much you use your vehicle.

Sole Trader

Using the FULL RATE METHOD means:

- You use the vehicle almost exclusively for work purposes.

- The vehicle gets very little personal use.

- You can claim fuel, servicing, insurance, and tax as expenses.

- You can claim back VAT.

- You can also claim the cost of the vehicle itself, as a capital allowance.

- BUT you can’t expense fines, or any private use of the vehicle (which is calculated as a percentage of your total annual mileage).

Using the MILEAGE RATE METHOD means:

- You use the vehicle predominantly for private use.

- You only use the vehicle for the odd work trip here and there.

- You calculate your expense allowance based on the table above.

- You can also expense toll charges, the congestion charge and parking.

- BUT it excludes any private use of the vehicle, fuel, servicing, insurance, tax and any fines.

- You can’t use this method to claim back VAT either.

Limited Company

The complication with a limited company is that everyone that works there is usually classed as an employee of the company (as distinct from a self-employed sole trader).

And what does this mean? Well, it means that a work vehicle effectively belongs to the company, not the individual. Which has tax repercussions.

Using the FULL RATE METHOD means:

- You are using a company vehicle for “business travel”.

- You cannot make the same personal mileage deduction a sole trader can when using this method.

- Any private use of the company vehicle is classed as a taxable benefit in kind. And as such it will need to be included on your personal tax return.

- You can claim expenses for fuel, servicing, insurance, tax.

- You can also claim for the vehicle itself (as above, classing it as a capital allowance).

- You can’t claim expenses for private use, or any fines.

This method only really works for a limited company if the vehicle gets no, or very little, personal use.

Using the MILEAGE RATE METHOD means:

- The vehicle is owned privately, not by the company.

- BUT you can claim a mileage allowance for “business travel”.

- You can also claim on additional passengers in the vehicle for business journeys (currently 5p per passenger, per mile).

- Toll charges, the congestion charge and parking can be claimed as expenses.

- But you cannot claim any mileage expense from private use of the vehicle, fuel, servicing, insurance, tax, the cost of the vehicle as a capital allowance, or any fines incurred.

Claiming VAT as a limited company can be done with either method. It’s a little complex, so best to check with HMRC on that one.

Skimmed Through This Article? Let’s Recap

If nothing else, remember this:

- Always, always ensure your mileage log is accurate and up to date.

- How much you use a vehicle for work will determine what the best way of claiming expenses is.

- Clearly define what counts as “business travel” in your line of work.

- Zervant provides free online invoicing software to ensure you get paid for all the work you do.

SOURCES – gov.uk, citizensadvice.org.uk, HMRC, Pexels, StockSnap