A Beginner’s Guide to Profit and Loss Statements

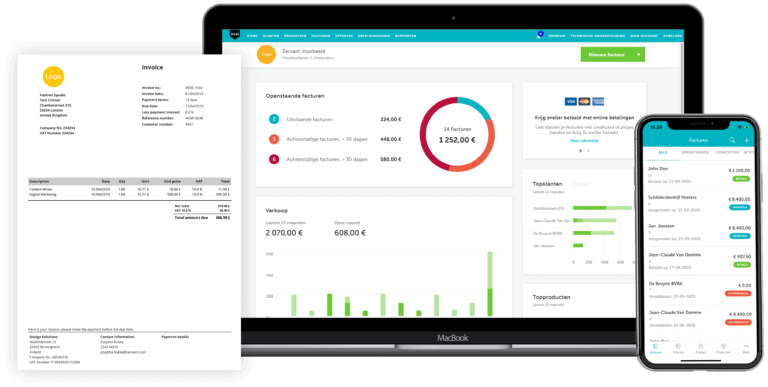

To run a successful business you need to know a little bit about the complex world of finance and accounting, including profit and loss statements. As Zervant’s main mission is to make running your own business as pain free as possible, we thought it would be useful to create a beginner’s guide. You might already know a few of the basics, but we’ve covered what a profit and loss statement is, and why it’s important for small business.

Table of Contents

What Is A Profit and Loss Statement?

Accounting is full of jargon, so you’ll also hear a profit and loss statement referred to as an income statement, a profit and loss account, or even a ‘P&L’ for short. Whatever name it goes by, all it means is a record of your business’ profits and losses, over a defined period of time.

You can specify the period time of time, depending on your needs. It’s typically set on a monthly, quarterly, or yearly basis. But by law you’re required to produce financial statements for your business every year. Along with a profit and loss statement, the other main type of financial statement you’ll encounter is the balance sheet.

How Do You Calculate A Profit and Loss Statement?

We like to keep things as simple as possible, and ‘P&L’ is no exception. Whatever abstract terms or acronyms you encounter, just remember that the money your business makes, minus the money it spends, will tell you what your profit is.

The magic formula that you need to bear in mind is “sales minus expenditure = profit”

The upper section of a profit and loss account is known as the trading account (as it reflects your business’ trading activities). This will give you a figure for how much gross profit your business has made. Gross profit is the total sales revenue minus the cost of the sales (more on this below).

Of course, your business will have other expenses, such as overheads, which need to be subtracted from the gross profit. This sum, the gross profit minus any other business expenses, is shown underneath the trading account. The gives you a figure for your net profit – the amount of money made by your business once all expenses have been deducted.

What Do All the Acronyms Mean?

If you’ve followed the above then you’re more or less done with the theory of profit and loss statements. But as we said, accountants love their jargon. So you’ll need to be familiar with the following terms too:

COGS – cost of goods sold

This covers things like the cost of employing your staff, your office space, and any materials that you use. All costs that relate directly to getting your product ready for sale come under this category.

COS – cost of service

Not much difference with COGS. The terms can be used interchangeably on your profit and loss statement (just to make it a little more confusing!). The term is perhaps more used in service based businesses, who don’t have actual products/goods they sell (eg. doctors or lawyers).

SG&A – selling, general and administrative costs

This covers all the major non-production costs your business has. It includes marketing, any legals fees, and advertising, for example.

These acronyms are applicable to the formulas discussed above. So total sales minus COGS/COS gives you your gross profit. Gross profit shows how much money you’re business has made in total, for the defined period of your profit and loss statement.

And if you subtract the SG&A from this figure (essentially your monthly running costs), you get your net profit.

The Key to Success

This probably all feels a bit long winded. But a profit and loss statement certainly has its uses. When used correctly it’s more than just a legal requirement to keep your accountant happy! It’s also a valuable analytical tool that shows where your business is doing well, and where it needs to improve.

Most businesses sell more than one product or service. So when recording sales in the trading account section of your profit and loss statement, you can split the sales into sub-sale sections. These sections, added together, give a figure for total business sales.

For example, if you run a coffee shop then you could divide your sales into the following categories:

- Take away customers

- Sit in customers

- Customers buying products (coffee beans, filters, etc)

You can see what generates the most money, and what you might want to focus on in the future. Depending on how much detail you require, you can break down your costs and outgoings into subcategories too, which will show where all your hard earned cash is going.

This is certainly valuable information to have. But where do you find the time to collate all this data? And then how do you analyse all the figures in your profit and loss statement and turn them into business insight?