German E-invoicing for English Speakers | A guide to XRechnung, Peppol & Zugferd

Table of Contents

E-invoicing in Germany

In November 2020, the German government introduced legislation requiring all businesses providing goods and services to the public sector to submit invoices electronically. They settled on an e-invoicing format known as XRechnung and plunged many businesses into operational darkness – forcing them to use a new technology, with little understanding about how it works.

For many small business owners, the introduction of this legislation was the first they’d heard of e-invoicing and information about the German system can be hard to find in English. At Zervant, we felt a duty to address this gap in understanding – not only as a provider of e-invoicing capable software, but as an information hub for small business operators across Europe.

Below we shed some light on German e-invoicing practices, the underlying technologies and how you can create and send e-invoices as an English speaker living in Germany.

E-invoicing in a nutshell

Although e-invoicing simply means “electronic invoicing”, it refers to a very specific set of electronic invoicing formats. E-invoicing does not mean online invoicing, invoicing apps or sending invoices by email (even though these are technically “electronic”).

An e-invoice contains all the same information as any other invoice except that the information is stored in a machine-readable, electronic data format.

E-invoicing provides a low-cost, hyper efficient way for businesses to send and receive invoices because of a few reasons; there is no paper involved in the process, invoice transfer is almost instantaneous and, because the receiver sets the format, invoices cannot reach the receiver in an unreadable state and can be processed extremely quickly.

Check out our simple explainer video:

How e-invoicing works

E-invoices might make your life simple, but under the surface they can be a little complicated to understand. Because of this, it’s only really viable for businesses to create e-invoices using a compatible invoicing software. For you, this means the invoice creation process is pretty much the same; however, after this point the process looks very different.

As you may have a number of different customers or suppliers and there are a number of different e-invoicing formats, it would be costly to establish a new, direct connection between your system and each of theirs. Instead, e-invoices are routed via an e-invoicing service provider or “hub” who acts as a central point of contact.

The EESPA explains these different e-invoicing models well but here we’ve summarised the basic steps:

- You create and send an invoice in a compatible software

- Your invoicing software communicates with an e-invoicing operator (these are like old-school phone operators) who completes the connection to the recipient’s system

- The recipient’s system receives the invoice and, if approved, the invoice is paid and the confirmation is received

What e-invoices look like

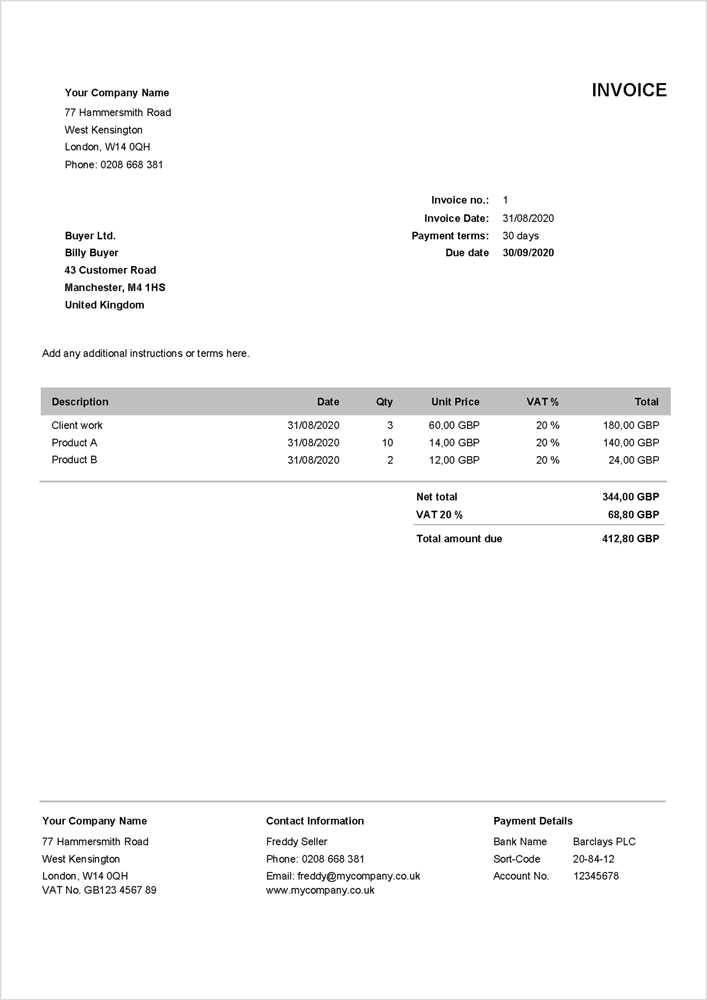

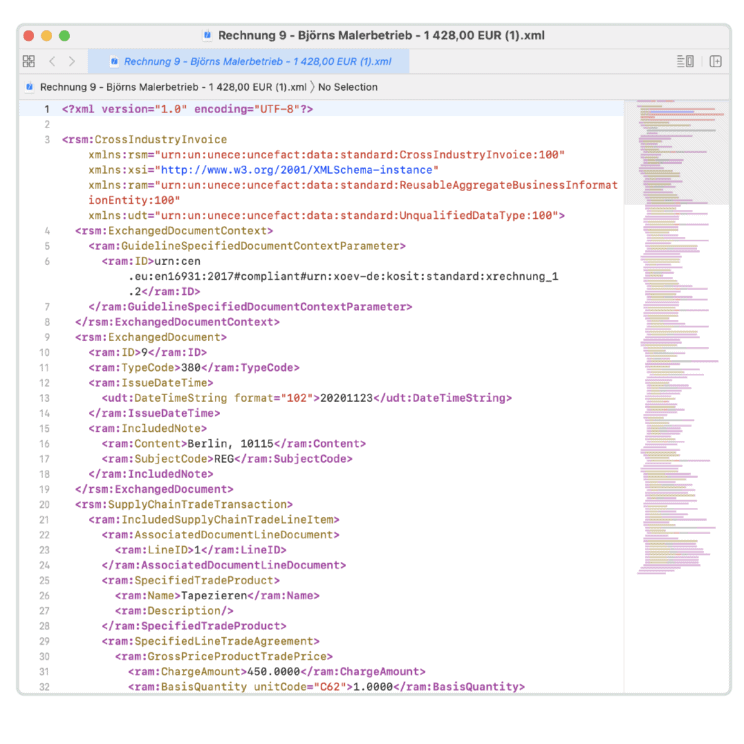

Though it’s not important to understand what the “machine-friendly” code means, we thought it would be helpful to illustrate what you see vs what the machine sees. Check out the below images.

The above image on the left is a typical invoice (taken from one of our free invoice templates). You fill in all the details and maybe send it via email as a PDF document.

On the right is what this same invoice looks like in a machine-readable, e-invoice format. This one in particular is an example of the XML e-invoice format known as XRechnung, but more on that later.

What goes on an e-invoice

As was already mentioned, e-invoices contain all the same information as any other invoice, only in a different format. You’ll be familiar with the following:

- Your contact information (an email is required)

- Your customer’s contact information

- The products or services provided

- Prices & taxes, subtotals and totals

- Date issued, due date

- Payment information

- Comments

There is however one very important piece of information that you need to send an e-invoice and that’s the e-invoicing address of the company you will invoice. You can read our help centre article on e-invoice addresses for more information.

E-invoicing addresses in Germany

E-invoice addresses differ depending on the country you’re in but some of the most commonly used formats are Routing ID, VAT ID, GLN, DUNS and IBAN.

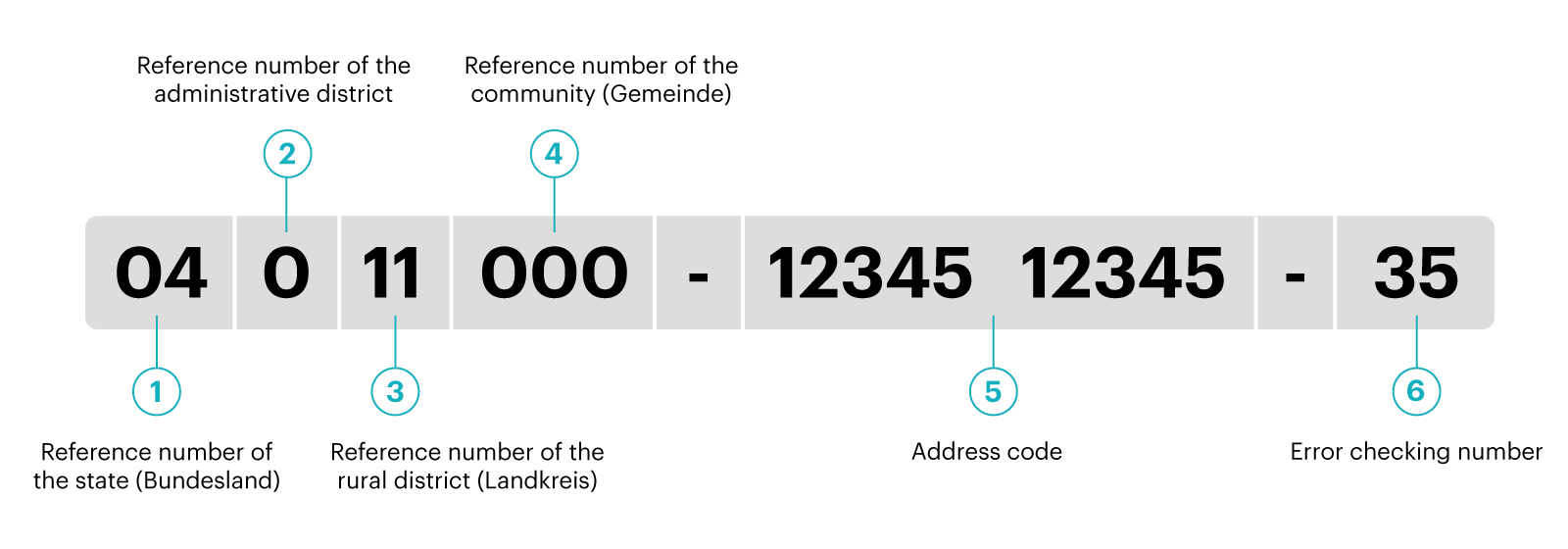

Public authorities in Germany will often use the “Leitweg-ID” (route-ID in English) as an e-billing address. This normally takes the following format:

Companies sometimes use their sales tax ID number, e.g. 1234:123456789.

If a company requires suppliers to submit e-invoices, they may even show an e-invoicing address on their website – this may be referred to as their “Peppol ID” or “Participant ID”. When in doubt, just ask your customer for their full e-invoicing address.

- Reference number of the state (Bundesland)

- Reference number of the administrative district

- Reference number of the rural district (Landkreis)

- Reference number of the community (Gemeinde)

- Address code

- Error checking number

E-invoicing formats in Germany

As an entrepreneur in Germany, it’s important to recognise these common e-invoicing formats. Keep in mind that: with a good invoicing software, the difference in format is negligible to the invoice creation process. As long as the software you use is partnered with a suitable e-invoice operator for the format you require, sending e-invoices is a breeze.

ZUGFeRD

Created by the German electronic invoicing forum (Forum elektronische Rechnung Deutschland, FeRD) with support from the Federal Ministry for Economic Affairs and Energy, ZUGFeRD is a cross-industry, hybrid e-invoicing format.

ZUGFeRD takes a regular PDF invoice document and embeds in it a duplicate of the invoice data in the machine-readable XML format. Because of this hybrid formatting, ZUGFeRD is best suited for B2B applications, where flexibility between companies is important and people are still working hands-on with invoices.

As ZUGfeRD Standard 1.0 is not compatible with XRechnung requirements, companies invoicing the public sector should only consider adopting this format from version 2.0 or later.

XRechnung

XRechnung is the standard e-invoicing format in use by the public sector in Germany since November 2020. “X” refers to the XML format which invoice data is stored in for easy processing by computers.

XRechnung is an important format because it facilitates the automatic processing of invoices across an overly bureaucratic and multi-layered public sector. Service providers are paid faster because of the improved automation and, down the line, the German tax payer benefits from this reduced cost and improved efficiency.

At the end of this page on the city of Bremen digital services website, you can download various up to date PDF files explaining XRechnung in English.

PEPPOL

PEPPOL is an acronym for Pan-European Public Procurement Online. PEPPOL is a framework which aims to facilitate cross-border economic activity by creating a common set of artefacts and specifications for eProcurement. One of these artefacts is e-invoices.

In layman’s terms, PEPPOL is a network which you connect to in order to send and receive documents in a standard format. According to the EU, PEPPOL e-invoices are going to become the future cross-European standard for e-invoicing. PEPPOL aims to replace the local standards set within EU countries and many private actor companies are already mandating for PEPPOL adoption.

The benefits of everyone using the PEPPOL standard are obvious, though it raises the question – how does someone start sending e-invoices on the PEPPOL network? That’s where PEPPOL Access Points come in.

Over 300 companies are certified as PEPPOL access points and these companies connect with many invoice creation tools that you might have heard of (hint: Zervant).